MRP glossary TOP > F > Full Costing

Full Costing

Full Costing

Cost is divided, in terms of the costing range and object, into full cost and part cost. In actual cost method and standard cost accounting, all costs for producing and selling products are collectively calculated. Such cost calculation is called Full Costing. On the other hand, the cost calculation with some expenses is called Part Costing, or Direct Costing. In financial accounting, Full Costing is used, but Direct Costing is more suitable for cost control because sales volume and profits are not always matched.

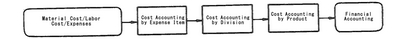

The procedure of full costing is the same as that of actual cost accounting or standard cost accounting, where unit cost is obtained by dividing the cost into direct cost and indirect cost, next categorizing them into manufacturing division and subsidiary division and summarizing each of them, and finally imposing each cost on products directly.

The procedure of full costing is the same as that of actual cost accounting or standard cost accounting, where unit cost is obtained by dividing the cost into direct cost and indirect cost, next categorizing them into manufacturing division and subsidiary division and summarizing each of them, and finally imposing each cost on products directly.

Related term: Cost Accounting

Cost is divided, in terms of the costing range and object, into full cost and part cost. In actual cost method and standard cost accounting, all costs for producing and selling products are collectively calculated. Such cost calculation is called Full Costing. On the other hand, the cost calculation with some expenses is called Part Costing, or Direct Costing. In financial accounting, Full Costing is used, but Direct Costing is more suitable for cost control because sales volume and profits are not always matched.

Related term: Cost Accounting

Reference:JIT Business Research Mr. Hirano Hiroyuki