MRP glossary TOP > Cost Control > Actual Cost Method

Actual Cost Method

Actual Cost Method Cost Accounting

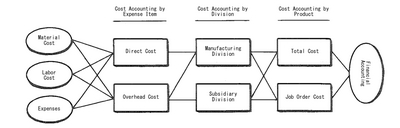

It is to calculate, after the production of a product was over, an after-the-fact cost using the actual quantity and acquisition price consumed in the production process. This is suitable for financial statements because the manufacturing costs of products, semifinished products, and in-process items actually required and consumed in the production process. In financial accounting, the product cost is calculated with actual costs as a general rule. But, scheduled price, scheduled labor cost per hour, and scheduled burden rate are sometimes used for material price, labor cost, and indirect cost, respectively. Although the Actual Cost Method is necessary for settlement report, actual costs are used as appropriate ones and thus it may be difficult to identify the criterial actual costs and the causes of Failure Rate. Therefore focusing on the thorough cost control, it is necessary to use it along with Standard Cost Accounting. In Actual Cost Method, the calculation is made in the order of cost by expense item, by division, and by product.

It is to calculate, after the production of a product was over, an after-the-fact cost using the actual quantity and acquisition price consumed in the production process. This is suitable for financial statements because the manufacturing costs of products, semifinished products, and in-process items actually required and consumed in the production process. In financial accounting, the product cost is calculated with actual costs as a general rule. But, scheduled price, scheduled labor cost per hour, and scheduled burden rate are sometimes used for material price, labor cost, and indirect cost, respectively. Although the Actual Cost Method is necessary for settlement report, actual costs are used as appropriate ones and thus it may be difficult to identify the criterial actual costs and the causes of Failure Rate. Therefore focusing on the thorough cost control, it is necessary to use it along with Standard Cost Accounting. In Actual Cost Method, the calculation is made in the order of cost by expense item, by division, and by product.

Reference:JIT Business Research Mr. Hirano Hiroyuki